rsu tax rate canada

The beauty of rsus is in the simplicity of the way they get taxed. On May 15 2012 ABC hit 15 and Sue sold the 54 shares of ABC Corp.

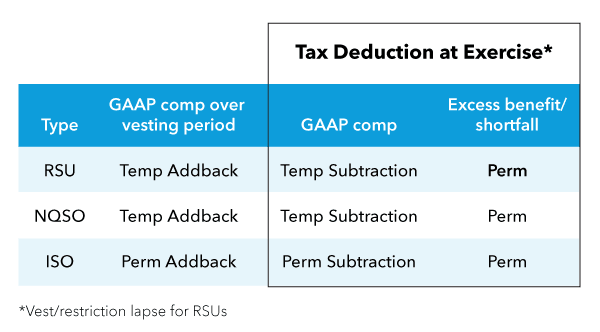

Asc 740 Stock Based Compensation Bloomberg Tax

The general rule is that the full amount of this taxable benefit is included in income and subject to tax in the year the option is exercised and shares are acquired.

. At any rate RSUs are seen as supplemental income. Im curious how tech companies do tax deductions when granting RSUs in Canada. My RSUs got taxed at highest Ontario tax rate on the whole vested amount.

Growth after they vest will be taxed like capital gains half your marginal rate. Taxes are usually withheld on income from RSUs. 613-751-6674 Chantal Baril Tel.

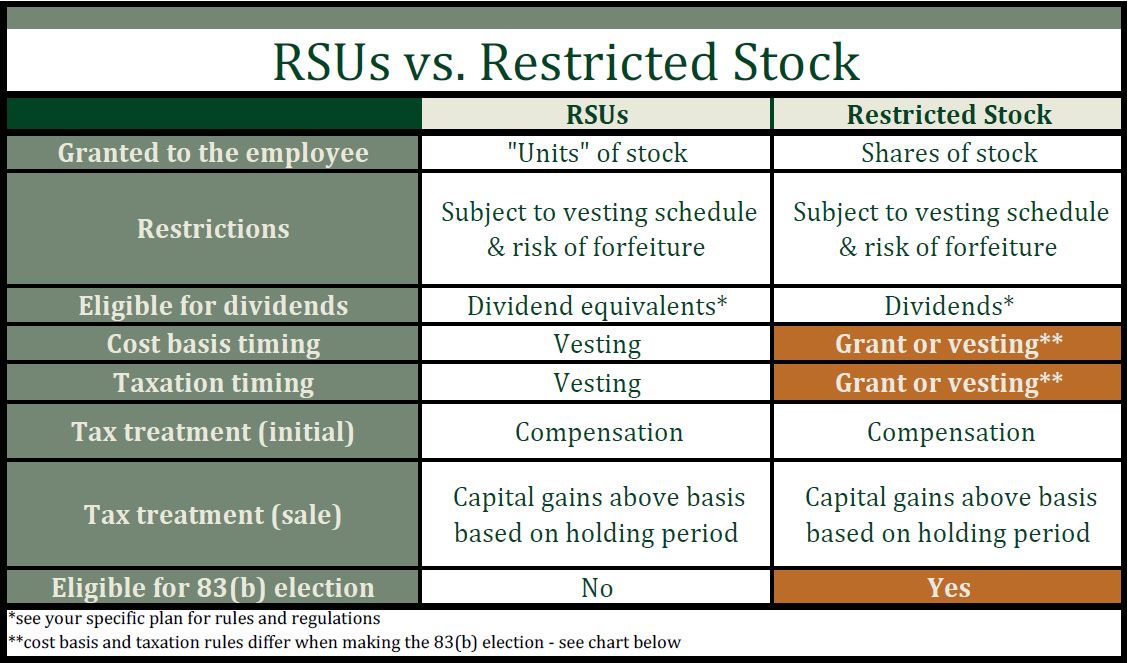

A friend of mine told me they typically deduct the highest marginal tax rate 50 and so you. If your options were issued and certain other. Note that unlike stock options which are eligible for the stock option deduction and hence are taxed at 50 percent there is no favourable tax treatment accorded to RSUs.

Canadas top marginal rate is 53. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Generally tax at vesting for RSU.

If properly structured including either i a vesting period of no more than 3 years or ii share-settled only RSUs are taxed only upon vesting. The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts.

Also restricted stock units are subject. RSUs are treated like income as they should be. If RSUs are settled in cash or can be settled in cash or shares.

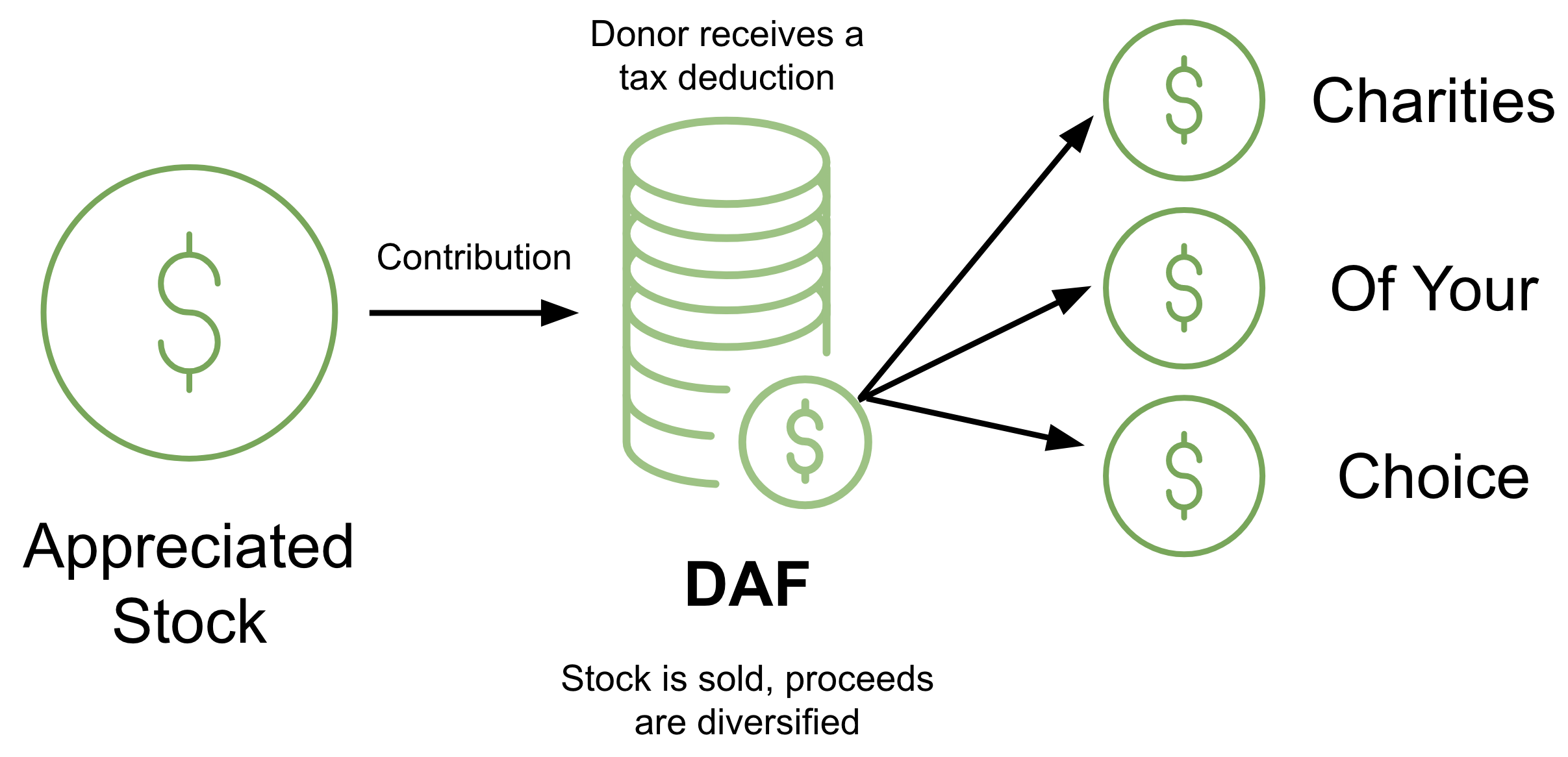

Most companies will withhold federal income taxes at a flat rate of 22. RSUs can trigger capital gains tax but only if the. Alice has 25000 worth of rsu stock vest in 2019 meaning alice now owns the stock outright.

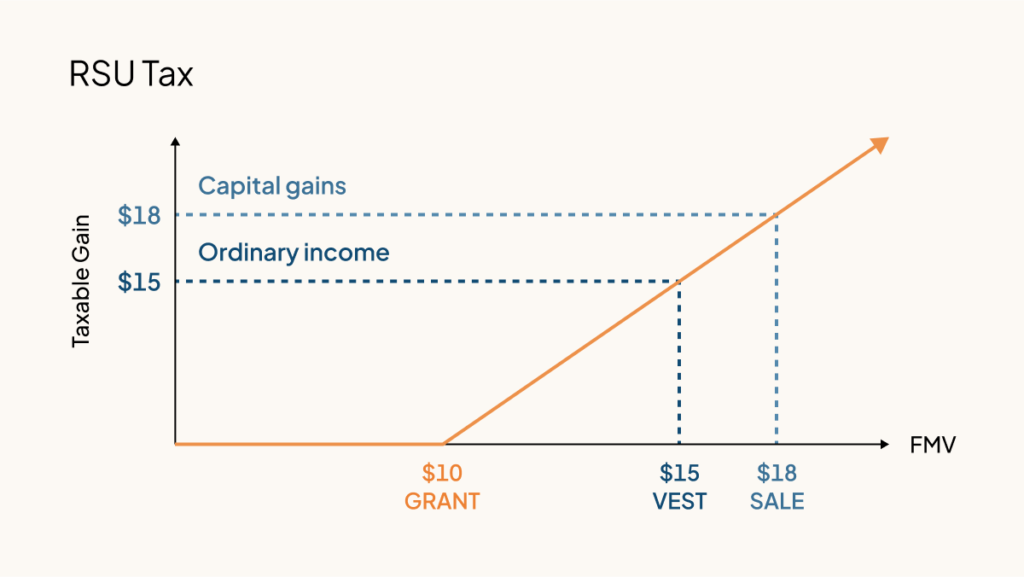

As you might assume this fundamental difference leads to stock options and RSUs being treated differently under tax laws. Taxable amount is fair market value of the shares on the tax event. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

RSUs are taxed at ordinary income rates when issued typically after vesting. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. The value of over 1 million will be taxed at 37.

Upon the sale of shares generally. When i was a Canada employee. Capital gains tax is imposed only if the stockholder.

My RSUs also got taxed at aq prorated basis in the US. Ordinary Income Tax. What the CRA has brought forward is a new methodology of sourcing and is referred to as the Hybrid Methodology They have stated this methodology will be their.

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu Taxes Explained 4 Tax Strategies For 2022

A Literature Review On The Dual Effect Of Corporate Tax Planning And Managerial Power On Executive Compensation Structure Hlaing 2022 Accounting Perspectives Wiley Online Library

Rsus Vs Stock Options What S The Difference Carta

How To Avoid Taxes On Rsus Equity Ftw

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

An Opportunity To Save On Income Taxes Bny Mellon Wealth Management

Ca Hybrid Methodology For Sourcing Certain Rsus Kpmg Global

Canada Taxation Of International Executives Kpmg Global

How Do I Diversify My Rsus Executive Benefit Solutions

Rsa Vs Rsu What S The Difference Carta

Canada Government Moves Forward With Deduction Limit On Stock Options

Are Rsus Taxed Twice Rent The Mortgage